Скачать с ютуб How to Account for Early Retirement of Bonds в хорошем качестве

Скачать бесплатно How to Account for Early Retirement of Bonds в качестве 4к (2к / 1080p)

У нас вы можете посмотреть бесплатно How to Account for Early Retirement of Bonds или скачать в максимальном доступном качестве, которое было загружено на ютуб. Для скачивания выберите вариант из формы ниже:

Загрузить музыку / рингтон How to Account for Early Retirement of Bonds в формате MP3:

Если кнопки скачивания не

загрузились

НАЖМИТЕ ЗДЕСЬ или обновите страницу

Если возникают проблемы со скачиванием, пожалуйста напишите в поддержку по адресу внизу

страницы.

Спасибо за использование сервиса savevideohd.ru

How to Account for Early Retirement of Bonds

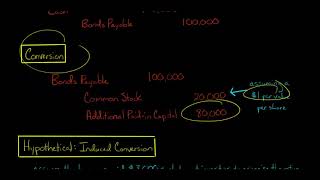

This video explains how to account for the early retirement of bonds (aka early extinguishment of debt or early redemption of bonds). When a company retires (redeems) its bonds prior to the maturity date, the company must do several things: -Reduce the cash account by the amount used to repurchase the bonds (if cash is used to retire the bonds) -Remove the bonds payable -Zero out the unamortized discount or unamortized premium -Record a gain or loss IF the repurchase price is different from the carrying value (aka book value) of the bonds on the date the bonds are retired There are two ways to calculate the gain or loss on the early retirement of the bonds: (1) record the journal entry; if a debit is required to make the journal entry balance, then debit a loss on early retirement (or loss on bond redemption, loss on early extinguishment of debt, etc.). If a credit is instead required to make the journal entry balance, the credit a gain on early retirement (or gain on bond redemption, gain on early extinguishment of debt, etc.) (2) calculate the difference between the repurchase price (the amount paid to retire the bonds) and carrying value (aka book value) of the bonds at the time they are retired. If the repurchase price is less than the carrying value, there is a gain. If the repurchase price is greater than the carrying value, there is a loss. 0:00 Introduction 0:39 4 things to do when retiring bonds 1:20 Example 3:59 T-account for discount on bonds payable 4:18 Journal entry to record gain on retirement of bonds 5:53 Alternative situation (loss on retirement of bonds) — Edspira is the creation of Michael McLaughlin, an award-winning professor who went from teenage homelessness to a PhD. Edspira’s mission is to make a high-quality business education freely available to the world. — SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS, PLUS: • A 23-PAGE GUIDE TO MANAGERIAL ACCOUNTING • A 44-PAGE GUIDE TO U.S. TAXATION • A 75-PAGE GUIDE TO FINANCIAL STATEMENT ANALYSIS • MANY MORE FREE PDF GUIDES AND SPREADSHEETS * http://eepurl.com/dIaa5z — SUPPORT EDSPIRA ON PATREON * / prof_mclaughlin — GET CERTIFIED IN FINANCIAL STATEMENT ANALYSIS, IFRS 16, AND ASSET-LIABILITY MANAGEMENT * https://edspira.thinkific.com — LISTEN TO THE SCHEME PODCAST * Apple Podcasts: https://podcasts.apple.com/us/podcast... * Spotify: https://open.spotify.com/show/4WaNTqV... * Website: https://www.edspira.com/podcast-2/ — GET TAX TIPS ON TIKTOK * / prof_mclaughlin — ACCESS INDEX OF VIDEOS * https://www.edspira.com/index — CONNECT WITH EDSPIRA * Facebook: / edspira * Instagram: / edspiradotcom * LinkedIn: / edspira — CONNECT WITH MICHAEL * Twitter: / prof_mclaughlin * LinkedIn: / prof-michael-mclaughlin — ABOUT EDSPIRA AND ITS CREATOR * https://www.edspira.com/about/ * https://michaelmclaughlin.com