Скачать с ютуб Modern Portfolio Theory (MPT) and the Capital Asset Pricing Model (CAPM) (FRM P1 2021 – B1 – Ch5) в хорошем качестве

Скачать бесплатно Modern Portfolio Theory (MPT) and the Capital Asset Pricing Model (CAPM) (FRM P1 2021 – B1 – Ch5) в качестве 4к (2к / 1080p)

У нас вы можете посмотреть бесплатно Modern Portfolio Theory (MPT) and the Capital Asset Pricing Model (CAPM) (FRM P1 2021 – B1 – Ch5) или скачать в максимальном доступном качестве, которое было загружено на ютуб. Для скачивания выберите вариант из формы ниже:

Загрузить музыку / рингтон Modern Portfolio Theory (MPT) and the Capital Asset Pricing Model (CAPM) (FRM P1 2021 – B1 – Ch5) в формате MP3:

Если кнопки скачивания не

загрузились

НАЖМИТЕ ЗДЕСЬ или обновите страницу

Если возникают проблемы со скачиванием, пожалуйста напишите в поддержку по адресу внизу

страницы.

Спасибо за использование сервиса savevideohd.ru

Modern Portfolio Theory (MPT) and the Capital Asset Pricing Model (CAPM) (FRM P1 2021 – B1 – Ch5)

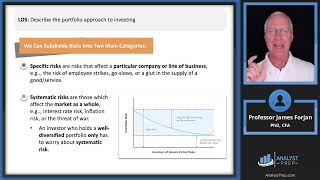

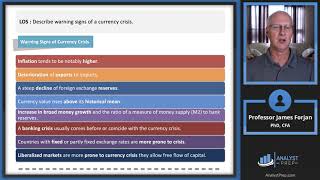

For FRM (Part I & Part II) video lessons, study notes, question banks, mock exams, and formula sheets covering all chapters of the FRM syllabus, click on the following link: https://analystprep.com/shop/unlimite... AnalystPrep is a GARP-Approved Exam Preparation Provider for FRM Exams After completing this reading you should be able to: - Explain modern portfolio theory and interpret the Markowitz efficient frontier. - Understand the derivation and components of the CAPM. - Describe the assumptions underlying the CAPM. - Interpret the capital market line. - Apply the CAPM in calculating the expected return on an asset. - Interpret beta and calculate the beta of a single asset or portfolio. - Calculate, compare and interpret the following performance measures: the Sharpe performance index, the Treynor performance index, the Jensen performance index, the tracking error, information ratio and Sortino ratio. 0:00 Introduction 0:15 Learning Objectives 0:55 Assumptions Underlying the CAPM 9:21 Interpreting Beta 16:53 Example on Beta 19:57 Derivation of CAPM 21:39 The Capital Market Line 28:53 The Treynor Measure: Analogy 32:41 The Sharpe Measure 35:08 The Jensen Measure 44:54 The Tracking-Error: Example 46:09 The Information Ratio 48:19 The Sortino Ratio