Скачать с ютуб Volatility Smiles (FRM Part 2 2023 – Book 1 – Chapter 15) в хорошем качестве

Скачать бесплатно Volatility Smiles (FRM Part 2 2023 – Book 1 – Chapter 15) в качестве 4к (2к / 1080p)

У нас вы можете посмотреть бесплатно Volatility Smiles (FRM Part 2 2023 – Book 1 – Chapter 15) или скачать в максимальном доступном качестве, которое было загружено на ютуб. Для скачивания выберите вариант из формы ниже:

Загрузить музыку / рингтон Volatility Smiles (FRM Part 2 2023 – Book 1 – Chapter 15) в формате MP3:

Если кнопки скачивания не

загрузились

НАЖМИТЕ ЗДЕСЬ или обновите страницу

Если возникают проблемы со скачиванием, пожалуйста напишите в поддержку по адресу внизу

страницы.

Спасибо за использование сервиса savevideohd.ru

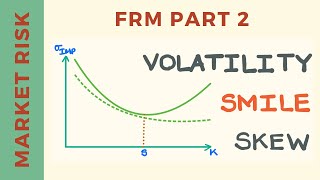

Volatility Smiles (FRM Part 2 2023 – Book 1 – Chapter 15)

For FRM (Part I & Part II) video lessons, study notes, question banks, mock exams, and formula sheets covering all chapters of the FRM syllabus, click on the following link: https://analystprep.com/shop/unlimite... AnalystPrep is a GARP-Approved Exam Preparation Provider for FRM Exams After completing this reading you should be able to: - Define volatility smile and volatility skew. - Explain the implications of put-call parity on the implied volatility of call and put options. - Compare the shape of the volatility smile (or skew) to the shape of the implied distribution of the underlying asset price and to the pricing of options on the underlying asset. - Describe characteristics of foreign exchange rate distributions and their implications on option prices and implied volatility. - Describe the volatility smile for equity options and foreign currency options and provide possible explanations for its shape. - Describe alternative ways of characterizing the volatility smile. - Describe volatility term structures and volatility surfaces and how they may be used to price options. - Explain the impact of the volatility smile on the calculation of the “Greeks.” - Explain the impact of a single asset price jump on a volatility smile. 0:00 Introduction 1:02 Learning Objectives 1:39 Introduction 6:11 What is a Volatility Smile? 8:03 Volatility Skew 10:08 Put-Call Parity on the Implied Volatility of Call and Put Options (2/2) 13:33 Volatility Smile vs. Implied Distribution of the Underlying Asset 14:26 Implied Volatility for Currency Options (1/2) 20:33 Implied Volatility for Equity Options (2/3) 27:24 Volatility Term Structure 29:27 Volatility Surface 31:04 The Impact of the Volatility Smile on the Calculation of the Greeks 34:16 Impact of a Single Asset Price Jump on a Volatility Smile (1/2)