Скачать с ютуб Expected shortfall (ES, FRM T5-02) в хорошем качестве

Скачать бесплатно Expected shortfall (ES, FRM T5-02) в качестве 4к (2к / 1080p)

У нас вы можете посмотреть бесплатно Expected shortfall (ES, FRM T5-02) или скачать в максимальном доступном качестве, которое было загружено на ютуб. Для скачивания выберите вариант из формы ниже:

Загрузить музыку / рингтон Expected shortfall (ES, FRM T5-02) в формате MP3:

Если кнопки скачивания не

загрузились

НАЖМИТЕ ЗДЕСЬ или обновите страницу

Если возникают проблемы со скачиванием, пожалуйста напишите в поддержку по адресу внизу

страницы.

Спасибо за использование сервиса savevideohd.ru

Expected shortfall (ES, FRM T5-02)

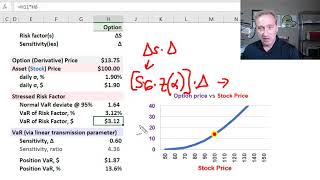

In this video, I'm going to show you exactly how we calculate expected shortfall under basic historical simulation. Expected shortfall is both desirable and timely. It's desirable because it is coherent, satisfies all four conditions of coherence, including subadditivity, whereas var does not. Second, it's timely because you may know that in Basel IV, specifically fundamental review the trading book VaR is being replaced by expected shortfall. So previously, this was more perhaps of academic interest and it is now popular and practical. 💡 Discuss this video here in our FRM forum: https://trtl.bz/2l65myk 👉 Subscribe here / bionicturtl. . to be notified of future tutorials on expert finance and data science, including the Financial Risk Manager (FRM), the Chartered Financial Analyst (CFA), and R Programming! ❓ If you have questions or want to discuss this video further, please visit our support forum (which has over 50,000 members) located at http://bionicturtle.com/forum 🐢 You can also register as a member of our site (for free!) at https://www.bionicturtle.com/register/ 📧 Our email contact is [email protected] (I can also be personally reached at [email protected]) For other videos in our Financial Risk Manager (FRM) series, visit these playlists: Texas Instruments BA II+ Calculator • Texas Instruments BA II+ Calculator Risk Foundations (FRM Topic 1) • Risk Foundations (FRM Topic 1) Quantitative Analysis (FRM Topic 2) • Quantitative Analysis (FRM Topic 2) Financial Markets and Products: Intro to Derivatives (FRM Topic 3, Hull Ch 1-7) • Financial Markets and Products: Intro... Financial Markets and Products: Option Trading Strategies (FRM Topic 3, Hull Ch 10-12) • Financial Markets and Products: Optio... FM&P: Intro to Derivatives: Exotic options (FRM Topic 3) • FM&P: Intro to Derivatives: Exotic op... Valuation and Risk Models (FRM Topic 4) • Valuation and RIsk Models (FRM Topic 4) Market Risk (FRM Topic 5) • Market Risk (FRM Topic 5) Coming Soon .... Credit Risk (FRM Topic 6) Operational Risk (FRM Topic 7) Investment Risk (FRM Topic 8) Current Issues (FRM Topic 9) For videos in our Chartered Financial Analyst (CFA) series, visit these playlists: Chartered Financial Analyst (CFA) Level 1 Volume 1 • Level 1 Chartered Financial Analyst (... #bionicturtle #risk #financialriskmanager #FRM #finance #expertfinance Our videos carefully comply with U.S. copyright law which we take seriously. Any third-party images used in this video honor their specific license agreements. We occasionally purchase images with our account under a royalty-free license at 123rf.com (see https://www.123rf.com/license.php); we also use free and purchased images from our account at canva.com (see https://about.canva.com/license-agree.... In particular, the new thumbnails are generated in canva.com. Please contact [email protected] or [email protected] if you have any questions, issues or concerns.