Скачать с ютуб How Payroll Taxes Affect Inequality в хорошем качестве

Из-за периодической блокировки нашего сайта РКН сервисами, просим воспользоваться резервным адресом:

Загрузить через ClipSave.ruСкачать бесплатно How Payroll Taxes Affect Inequality в качестве 4к (2к / 1080p)

У нас вы можете посмотреть бесплатно How Payroll Taxes Affect Inequality или скачать в максимальном доступном качестве, которое было загружено на ютуб. Для скачивания выберите вариант из формы ниже:

Загрузить музыку / рингтон How Payroll Taxes Affect Inequality в формате MP3:

Если кнопки скачивания не

загрузились

НАЖМИТЕ ЗДЕСЬ или обновите страницу

Если возникают проблемы со скачиванием, пожалуйста напишите в поддержку по адресу внизу

страницы.

Спасибо за использование сервиса savevideohd.ru

How Payroll Taxes Affect Inequality

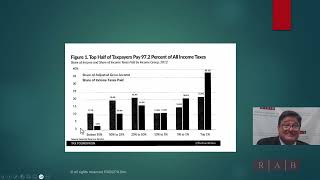

NJ Forensic Accountant Robert A. Bonavito Explains How Payroll Taxes Result in Inequality and How Much Money Taxpayers Actually Lose as a Result. I’m going to talk about inequality from the standpoint of taxes. Inequality has been around for over 3,000 years, but in the last 20 or 30 years, something in taxes has begun to result in inequality that many people don’t talk about – payroll taxes. If you look at the average couple, a lot of them start working at age 15 at the fast food restaurant or they work at the pool and then they work their whole life and they retire at age 67. That’s 52 years of work. During those 52 years of work, every year they contribute about 20% of their pay to payroll taxes, which includes unemployment, disability, social security, medicare. When you have payroll taxes, it’s taxes for federal and state tax. So, when you calculate it, it’s about 20% every year that this couple is paying into payroll taxes over 52 years. Now when you retire at age 67, of course you’re going to get something for that money, right? Because you paid it in for 52 years. The net present value (it’s paid social security and medicare and paid out over 30 years) after it’s taxed (because it’s taxed again) is about $300,000, which sounds good, right? But if the government took that 20% and invested it in an efficient market rate vehicle, when they retire at age 67, that couple would have $6.7 million in their bank account. So now, if you take the $300,000 and subtracted it, $6.4 million is missing. If you gave everyone who retired $6.7 million, inequality would be taken care of pretty quick. So, that really is one of the things that, when they talk about taxes or inequality, they need to focus on – that money that disappears. I have some theories about where it goes but that’s going to be done in another video. If you have any questions about payroll and taxes, feel free to give me an email or visit http://www.rabcpafirm.com/practices/t.... Robert A. Bonavito, CPA 1812 Front St. Scotch Plains, NJ 07076 908-322-7719 http://www.rabcpafirm.com/?utm_source...