Скачать с ютуб ₹1000 in PPF vs Mutual Funds Returns Calculations | Which is Better? [Hindi] в хорошем качестве

Скачать бесплатно ₹1000 in PPF vs Mutual Funds Returns Calculations | Which is Better? [Hindi] в качестве 4к (2к / 1080p)

У нас вы можете посмотреть бесплатно ₹1000 in PPF vs Mutual Funds Returns Calculations | Which is Better? [Hindi] или скачать в максимальном доступном качестве, которое было загружено на ютуб. Для скачивания выберите вариант из формы ниже:

Загрузить музыку / рингтон ₹1000 in PPF vs Mutual Funds Returns Calculations | Which is Better? [Hindi] в формате MP3:

Если кнопки скачивания не

загрузились

НАЖМИТЕ ЗДЕСЬ или обновите страницу

Если возникают проблемы со скачиванием, пожалуйста напишите в поддержку по адресу внизу

страницы.

Спасибо за использование сервиса savevideohd.ru

₹1000 in PPF vs Mutual Funds Returns Calculations | Which is Better? [Hindi]

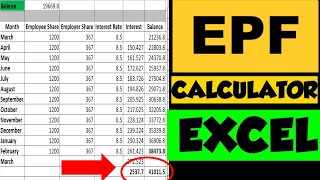

₹1000 in PPF vs Mutual Funds Returns Calculations | Which is Better? [Hindi] In this video by FinCalC TV we will see PPF vs mutual funds which is better with returns calculation using calculator in hindi. We will see deposits of Rs. 1000 in PPF and mutual funds every month for last 15 years and compare the returns or profits generated in both these options. Mutual Fund has given better returns compared to PPF in long term. PPF Calculator: https://fincalc-blog.in/ppf-calculato... SIP Calculator: https://fincalc-blog.in/mutual-fund-s... Income Tax on SIP: • Income Tax on ₹2000 SIP Returns | Mut... Mutual Funds for Beginners: • Mutual Funds for Beginners JOIN Telegram Group: https://t.me/fincalc_tv_channel CHAPTERS: 00:00 PPF vs Mutual Funds Intro 00:25 PPF Features & Benefits 01:34 What is Mutual Fund? 03:00 1000 PPF Interest Calculation 04:27 Using PPF Calculator on FinCalC Blog 10:10 Calculating Profits in PPF 11:11 1000 Mutual Fund Returns Calculation 13:56 Calculating maturity Amount in Mutual Funds 16:43 Using Other Calculators 17:57 Conclusion WHAT IS PPF? PPF full form is Public Provident Fund, which is a government backed Saving Scheme. Many Indians invest in PPF and treat it as a retirement fund since it has a lock-in period of 15 years. Also it helps in saving income tax while claiming deductions under Section 80C (maximum deduction up to Rs. 1.5 Lacs in a financial year) Features of PPF - PPF or Public Provident Fund is a savings scheme offered by the Government of India. - PPF has a lock-in period of 15 years - Minimum deposit amount in a FY to keep your PPF account active is Rs. 500 - Maximum deposit amount for which you can earn interest in PPF account is Rs. 1,50,000 - The interest on the account is paid by the government of India and is set every quarter, It is also tax-free. - PPF interest is calculated every month and is compounded annually - The applicable PPF interest rate for Jan 2022 to Mar 2022, has been fixed at 7.1% annually. - PPF or Public Provident Fund falls under EEE category (Exempt, Exempt, Exempt), which means, the Deposits, Interest and Maturity Amounts are all exempted from Income Tax - Partial withdrawals are allowed in PPF account - Loan facility is also available in PPF account WHAT IS MUTUAL FUNDS SIP? SIP full form is Systematic Investment Plan. SIP is a way to invest in mutual funds or any investment option every month regularly. In this article we will consider SIP as investments in mutual funds for simplicity. You can also do SIP in Stocks or Shares of companies. Below are some benefits of SIP: Rupee Cost Averaging: This is the term derived from dollar cost averaging but let’s understand this in terms of rupee! The fact that SIP invests in mutual funds regularly, helps you to buy less mutual funds units when market goes up (price goes up) and more mutual funds units when market goes down (price goes down). We will see this in examples below. Lowering risk: As compared to lump sum investing where you invest entire amount in one go after seeing a small drop in market, your SIPs help you to balance your investment value by seeing the ups and downs of market while helping you invest regularly. This lowers the risk in SIP. Mental Strength: In SIP you do not pay huge amount up front like lump sum investing. You always pay a fraction of amount which you can afford to invest and reap benefits over long term. Achieving goals: You must have heard about – “Slow and steady wins the race“. It’s not about the sprints that you take but it’s about the marathon that you win slowly and with patience. SIP helps in achieving your long term goals by keeping aside some amount of money every month. #PPFvsMutualFunds #PPF #MutualFunds #SIP #FinCalCTV ============================ LIKE | SHARE | COMMENT | SUBSCRIBE Mujhe Social Media par FOLLOW kare: Facebook : / fincalctv Twitter : / fincalctv BLOG: https://fincalc-blog.in Telegram: https://t.me/fincalc_tv_channel Instagram: / fincalc_tv ============================ MORE VIDEOS: SIP Returns Calculation: • SIP Returns Calculation Examples - ₹2... Income Tax Calculator: • Income Tax Calculation Examples betwe... Loan EMI Calculator: • Home Loan EMI Calculator Excel with P... Loan EMI Prepayment Calculator: • Home Loan EMI Prepayment | How to Sav... ============================ DISCLAIMER: Examples and demo used are for Illustration purpose only and might not cover every detail of examples shown.