Скачать с ютуб Estimating Default Probabilities (FRM Part 2 – Book 2 – Credit Risk – Ch 9) в хорошем качестве

Скачать бесплатно Estimating Default Probabilities (FRM Part 2 – Book 2 – Credit Risk – Ch 9) в качестве 4к (2к / 1080p)

У нас вы можете посмотреть бесплатно Estimating Default Probabilities (FRM Part 2 – Book 2 – Credit Risk – Ch 9) или скачать в максимальном доступном качестве, которое было загружено на ютуб. Для скачивания выберите вариант из формы ниже:

Загрузить музыку / рингтон Estimating Default Probabilities (FRM Part 2 – Book 2 – Credit Risk – Ch 9) в формате MP3:

Если кнопки скачивания не

загрузились

НАЖМИТЕ ЗДЕСЬ или обновите страницу

Если возникают проблемы со скачиванием, пожалуйста напишите в поддержку по адресу внизу

страницы.

Спасибо за использование сервиса savevideohd.ru

Estimating Default Probabilities (FRM Part 2 – Book 2 – Credit Risk – Ch 9)

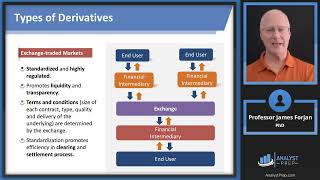

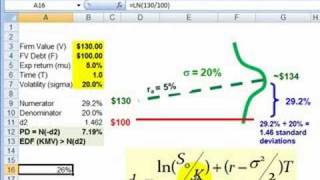

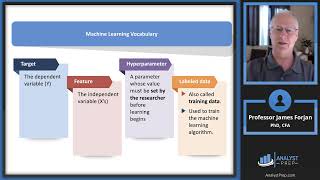

For FRM (Part I & Part II) video lessons, study notes, question banks, mock exams, and formula sheets covering all chapters of the FRM syllabus, click on the following link: https://analystprep.com/shop/unlimite... AnalystPrep is a GARP-Approved Exam Preparation Provider for FRM Exams For all other courses, including CFA, actuarial, and graduate admission products, click here: https://analystprep.com/courses/ After completing this reading, you should be able to: - Compare agencies’ ratings to internal credit rating systems. - Describe linear discriminant analysis (LDA), define the Altman’s Z-score and its usage, and apply LDA to classify a sample of firms by credit quality. - Describe the relationship between borrower rating and probability of default. - Describe a rating migration matrix and calculate the probability of default, cumulative probability of default, and marginal probability of default. - Define the hazard rate and use it to define probability functions for default time as well as to calculate conditional and unconditional default probabilities. - Describe recovery rates and their dependencies on default rates. - Define a credit default swap (CDS) and explain its mechanics including the obligations of both the default protection buyer and the default protection seller. - Describe CDS spreads and explain how CDS spreads can be used to estimate hazard rates. - Define and explain CDS-bond basis. - Compare default probabilities calculated from historical data with those calculated from credit yield spreads. - Describe the difference between real-world and risk-neutral default probabilities and determine which one to use in the analysis of credit risk. - Using the Merton model, calculate the value of a firm’s debt and equity, the volatility of firm value, and the volatility of firm equity. - Using the Merton model, calculate distance to default and default probability. - Assess the quality of the default probabilities produced by the Merton model, the Moody’s KMV model, and the Kamakura model.