Скачать с ютуб Fund Management (FRM Part 1 2023 – Book 3 – Chapter 3) в хорошем качестве

Скачать бесплатно Fund Management (FRM Part 1 2023 – Book 3 – Chapter 3) в качестве 4к (2к / 1080p)

У нас вы можете посмотреть бесплатно Fund Management (FRM Part 1 2023 – Book 3 – Chapter 3) или скачать в максимальном доступном качестве, которое было загружено на ютуб. Для скачивания выберите вариант из формы ниже:

Загрузить музыку / рингтон Fund Management (FRM Part 1 2023 – Book 3 – Chapter 3) в формате MP3:

Если кнопки скачивания не

загрузились

НАЖМИТЕ ЗДЕСЬ или обновите страницу

Если возникают проблемы со скачиванием, пожалуйста напишите в поддержку по адресу внизу

страницы.

Спасибо за использование сервиса savevideohd.ru

Fund Management (FRM Part 1 2023 – Book 3 – Chapter 3)

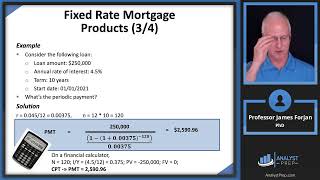

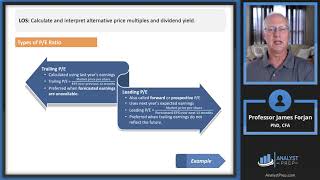

For FRM (Part I & Part II) video lessons, study notes, question banks, mock exams, and formula sheets covering all chapters of the FRM syllabus, click on the following link: https://analystprep.com/shop/unlimite... AnalystPrep is a GARP-Approved Exam Preparation Provider for FRM Exams After completing this reading you should be able to: - Understand who a fund manager is and the benefits of using fund managers - Differentiate among open-end mutual funds, closed-end mutual funds, and exchange-traded funds (ETFs). - Describe the various categories of open end mutual funds - Calculate the net asset value (NAV) of an open-end mutual fund. - Understand the various undesirable behaviors in trading - Explain the key differences between hedge funds and mutual funds. - Calculate the return on a hedge fund investment and explain the incentive fee structure of a hedge fund including the terms hurdle rate, high-water mark, and clawback. - Understand who a prime broker is - Describe various hedge fund strategies, including long/short equity, dedicated short, distressed securities, merger arbitrage, convertible arbitrage, fixed income arbitrage, emerging markets, global macro, and managed futures, and identify the risks faced by hedge funds. - Describe hedge fund performance and explain the effect of measurement biases on performance measurement. - Explain the findings of the research carried out on returns of mutual and hedge funds.