Скачать с ютуб Market-Based Valuation, Price and Enterprise Value Multiples (2024 Level II CFA® Exam –Module 4) в хорошем качестве

Скачать бесплатно Market-Based Valuation, Price and Enterprise Value Multiples (2024 Level II CFA® Exam –Module 4) в качестве 4к (2к / 1080p)

У нас вы можете посмотреть бесплатно Market-Based Valuation, Price and Enterprise Value Multiples (2024 Level II CFA® Exam –Module 4) или скачать в максимальном доступном качестве, которое было загружено на ютуб. Для скачивания выберите вариант из формы ниже:

Загрузить музыку / рингтон Market-Based Valuation, Price and Enterprise Value Multiples (2024 Level II CFA® Exam –Module 4) в формате MP3:

Если кнопки скачивания не

загрузились

НАЖМИТЕ ЗДЕСЬ или обновите страницу

Если возникают проблемы со скачиванием, пожалуйста напишите в поддержку по адресу внизу

страницы.

Спасибо за использование сервиса savevideohd.ru

Market-Based Valuation, Price and Enterprise Value Multiples (2024 Level II CFA® Exam –Module 4)

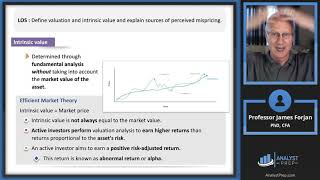

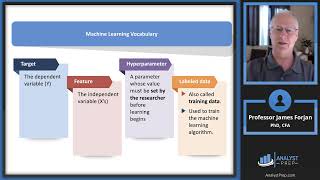

Prep Packages for the CFA® Program offered by AnalystPrep (study notes, video lessons, question bank, mock exams, and much more): Level I: https://analystprep.com/shop/cfa-leve... Level II: https://analystprep.com/shop/learn-pr... Levels I, II & III (Lifetime access): https://analystprep.com/shop/cfa-unli... Prep Packages for the FRM® Program: FRM Part I & Part II (Lifetime access): https://analystprep.com/shop/unlimite... Topic 5 – Equity Module 4 – Market-Based Valuation, Price and Enterprise Value Multiples 0:00 Introduction and LOS Outcome Statements 4:46 LOS: Distinguish between the method of comparables and the method based on forecasted fundamentals as approaches to using price multiples in valuation, and explain economic rationales for each approach. 8:08 LOS: Calculate and interpret a justified price multiple. 11:38 LOS: Describe rationales for and possible drawbacks to using alternative price multiples and dividend yield in valuation. 14:25 LOS: Calculate and interpret the justified leading and trailing P/Es using the Gordon growth model. 17:07 LOS: Calculate and interpret underlying earnings, explain methods of normalizing earnings per share (EPS), and calculate normalized EPS. 27:46 LOS: Explain and justify the use of earnings yield (E/P). 30:15 LOS: Describe fundamental factors that influence alternative price multiples and dividend yield. 30:54 LOS: Calculate and interpret the justified price-to-earnings ratio (P/E), price-to-book ratio (P/B), and price-to-sales ratio (P/S) for a stock, based on forecasted fundamentals. 36:17 LOS: Calculate and interpret a predicted P/E, given a cross-sectional regression on fundamentals, and explain limitations to the cross-sectional regression methodology. 39:22 LOS: Evaluate a stock by the method of comparables and explain the importance of fundamentals in using the method of comparables. 45:43 LOS: Calculate and interpret the P/E-to-growth ratio (PEG) and explain its use in relative valuation. 48:12 LOS: Calculate and explain the use of price multiples in determining terminal value in a multistage discounted cash flow (DCF) model. 50:34 LOS: Explain alternative definitions of cash flow used in price and enterprise value (EV) multiples and describe limitations of each definition. 51:34 LOS: Calculate and interpret EV multiples and evaluate the use of EV/EBITDA. 54:20 LOS: Explain sources of differences in cross-border valuation comparisons. 56:12 LOS: Describe momentum indicators and their use in valuation. 58:45 LOS: Explain the use of the arithmetic mean, the harmonic mean, the weighted harmonic mean, and the median to describe the central tendency of a group of multiples. 1:02:27 LOS: Evaluate whether a stock is overvalued, fairly valued, or undervalued based on comparisons of multiples.