Скачать с ютуб The Arbitrage-Free Valuation Framework (2024 Level II CFA® Exam – Fixed Income –Module 2) в хорошем качестве

Скачать бесплатно The Arbitrage-Free Valuation Framework (2024 Level II CFA® Exam – Fixed Income –Module 2) в качестве 4к (2к / 1080p)

У нас вы можете посмотреть бесплатно The Arbitrage-Free Valuation Framework (2024 Level II CFA® Exam – Fixed Income –Module 2) или скачать в максимальном доступном качестве, которое было загружено на ютуб. Для скачивания выберите вариант из формы ниже:

Загрузить музыку / рингтон The Arbitrage-Free Valuation Framework (2024 Level II CFA® Exam – Fixed Income –Module 2) в формате MP3:

Если кнопки скачивания не

загрузились

НАЖМИТЕ ЗДЕСЬ или обновите страницу

Если возникают проблемы со скачиванием, пожалуйста напишите в поддержку по адресу внизу

страницы.

Спасибо за использование сервиса savevideohd.ru

The Arbitrage-Free Valuation Framework (2024 Level II CFA® Exam – Fixed Income –Module 2)

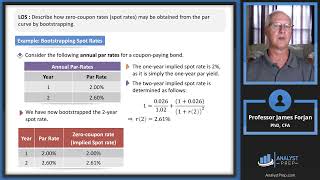

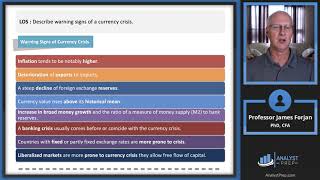

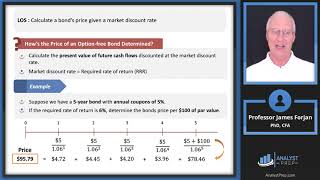

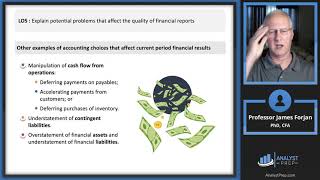

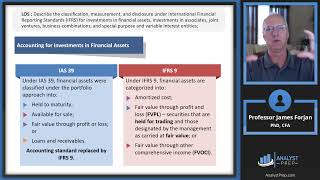

Prep Packages for the CFA® Program offered by AnalystPrep (study notes, video lessons, question bank, mock exams, and much more): Level I: https://analystprep.com/shop/cfa-leve... Level II: https://analystprep.com/shop/learn-pr... Levels I, II & III (Lifetime access): https://analystprep.com/shop/cfa-unli... Prep Packages for the FRM® Program: FRM Part I & Part II (Lifetime access): https://analystprep.com/shop/unlimite... Topic 6 – Fixed Income Module 2 – The Arbitrage-Free Valuation Framework 0:00 Introduction and Learning Outcome Statements 3:10 Explain what is meant by arbitrage-free valuation of a fixed-income instrument. 7:28 Calculate the arbitrage-free value of an option-free, fixed-rate coupon bond. 11:57 Describe a binomial interest rate tree framework. 17:40 Describe the backward induction valuation methodology and calculate the value of a fixed-income instrument given its cash flow at each node. 22:53 Describe the process of calibrating a binomial interest rate tree to match a specific term structure 29:24 Compare pricing using the zero-coupon yield curve with pricing using an arbitrage-free binomial lattice. 37:05 Describe pathwise valuation in a binomial interest rate framework and calculate the value of a fixed income instrument given its cash flows along each path. 39:43 Describe a Monte Carlo forward-rate simulation and its application. 41:20 Describe term structure models and how they are used.