Скачать с ютуб The Term Structure and Interest Rate Dynamics (2024 Level II CFA® Exam –Fixed Income–Module 1) в хорошем качестве

Скачать бесплатно The Term Structure and Interest Rate Dynamics (2024 Level II CFA® Exam –Fixed Income–Module 1) в качестве 4к (2к / 1080p)

У нас вы можете посмотреть бесплатно The Term Structure and Interest Rate Dynamics (2024 Level II CFA® Exam –Fixed Income–Module 1) или скачать в максимальном доступном качестве, которое было загружено на ютуб. Для скачивания выберите вариант из формы ниже:

Загрузить музыку / рингтон The Term Structure and Interest Rate Dynamics (2024 Level II CFA® Exam –Fixed Income–Module 1) в формате MP3:

Если кнопки скачивания не

загрузились

НАЖМИТЕ ЗДЕСЬ или обновите страницу

Если возникают проблемы со скачиванием, пожалуйста напишите в поддержку по адресу внизу

страницы.

Спасибо за использование сервиса savevideohd.ru

The Term Structure and Interest Rate Dynamics (2024 Level II CFA® Exam –Fixed Income–Module 1)

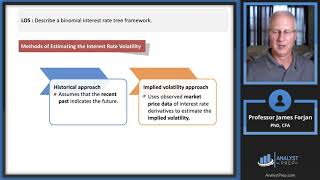

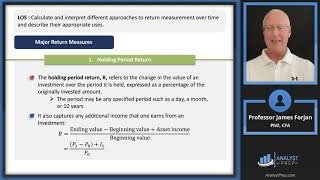

Prep Packages for the CFA® Program offered by AnalystPrep (study notes, video lessons, question bank, mock exams, and much more): Level I: https://analystprep.com/shop/cfa-leve... Level II: https://analystprep.com/shop/learn-pr... Levels I, II & III (Lifetime access): https://analystprep.com/shop/cfa-unli... Prep Packages for the FRM® Program: FRM Part I & Part II (Lifetime access): https://analystprep.com/shop/unlimite... Topic 6 – Fixed Income Module 1 – The Term Structure and Interest Rate Dynamics 0:00 Introduction and Learning Outcome Statements 2:14 LOS: Describe relationships among spot rates, forward rates, yield to maturity, expected and realized returns on bonds, and the shape of the yield curve. 9:20 LOS: Describe how zero-coupon rates (spot rates) may be obtained from the par curve by bootstrapping. 12:04 LOS: Describe the assumptions concerning the evolution of spot rates in relation to forward rates implicit in active bond portfolio management. 16:13 LOS: Describe the strategy of riding the yield curve. 18:33 LOS: Explain the swap rate curve and why and how market participants use it in valuation. 27:20 LOS: Calculate and interpret the swap spread for a given maturity. 28:30 LOS: Describe short-term interest rate spreads used to gauge economy- wide credit risk and liquidity risk. 28:30 LOS: Explain traditional theories of the term structure of interest rates and describe each theory’s implications for forward rates and the shape of the yield curve. 35:30 LOS: Explain how a bond’s exposure to each of the factors driving the yield curve can be measured and how these exposures can be used to manage yield curve risks. 40:30 LOS: Explain the maturity structure of yield volatilities and their effect on price volatility.